“By 2028, Canadian women will control $4 trillion in assets, almost doubling the $2.2 trillion they control today.” 1 As we celebrate the strides made in empowering women economically, it’s essential to recognize the remarkable evolution that has taken place in the world of finance and investment. Women now control a significant portion of householdContinue reading “International Women’s Day 2024: Invest & Inspire”

Nick Kempinski

Enter the Portal

Goodbye MyAccount This was MyAccount. For 11 years we built this product from scratch and grew it with you. For all of those that used it – thank you. There’s a mix of emotions as we can now say – it is no more. We’ve learned a lot from the initial questions and problems weContinue reading “Enter the Portal”

Think Payments First: Part V

Be proactive with your payments There are all sorts of problems you’ll face running your new business. Questions you never thought you would need answers for. How you go about finding solutions is some of the fun (though let’s be honest, sometimes it doesn’t feel like fun) When it comes to payments, sometimes the reactionaryContinue reading “Think Payments First: Part V”

Think Payments First: Part III

Payments in your industry At the beginning of building your business, you’re going to be scouring the world finding out how you fit. Who’s who in the zoo; who’s doing what; how they are doing it. You’ll be meeting new people, and looking at the competition & introducing yourself to customers. It’s easy to getContinue reading “Think Payments First: Part III”

Think Payments First: Part II

Planning payments first At the beginning of building your business, you’re going to be making a lot of plans. It’s easy to get swept up with exciting details. While you’re thinking about those details, Here’s our PSA: Think payments first, then think about the rest. Your initial business plan and market research have some heavyContinue reading “Think Payments First: Part II”

Think Payments First: Part I

Then think about the rest You want to start a business. Awesome! There are lots of great resources on what to do next: How to start a business Building a business plan Market research Finding and hiring a team Digital marketing Growth tactics These are just some of the exciting areas of your new businessContinue reading “Think Payments First: Part I”

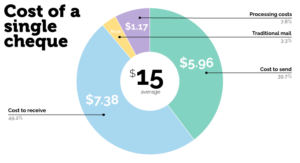

Why are you still using cheques?

For over 300 years, cheques have been the status quo for businesses (Really! The first cheque was written in 1659!). The world has evolved, and paying with physical cheques has become an outdated payments practice weighing down businesses with hidden costs. And still, Payments Canada stated that “Canadians still use close to a billion chequesContinue reading “Why are you still using cheques?”

Victoria-based fintech company Peloton raises $500,000 with participation from BDC to increase SME clientele in Canada and the U.S.

VICTORIA, January 20, 2021 – Peloton Technologies, a fintech company headquartered in Victoria, B.C., has secured $500,000 in new funding in order to grow its client base as small and medium-sized businesses shift their banking online because of COVID-19. Of this amount, $350,000 comes as non-dilutive financing from BDC’s Technology Industry Team, with the balanceContinue reading “Victoria-based fintech company Peloton raises $500,000 with participation from BDC to increase SME clientele in Canada and the U.S.”

Kicking off the Holidays with the Festival of Trees

Help support the BC Children’s Hospital Foundation The Festival of Trees has been an ongoing tradition in Victoria, BC for the last 28 years where trees are decorated to raise funds for BC Children’s Hospital Foundation. Each year the Bay Centre, in downtown Victoria, highlights decorated trees from various organizations & people. And while thisContinue reading “Kicking off the Holidays with the Festival of Trees”

PCI Compliance

What You Need to Know to Accept Credit Cards If you’re a business thinking of accepting credit cards, you need to know about the Payment Card Industry (PCI) data security standards. Because the information tied to credit cards is so sensitive, it’s important to have strict security measures in place, like the PCI Data SecurityContinue reading “PCI Compliance”